Helping your business grow

Developing and accompanying potential of industrial companies

Direction

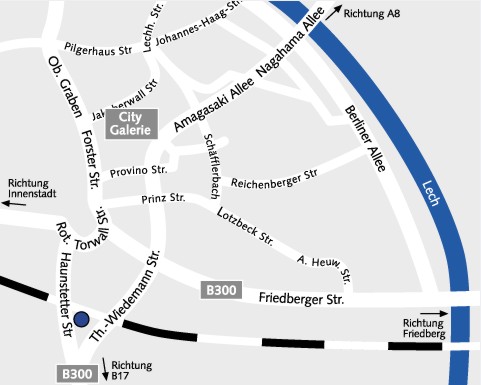

Franz Industriebeteiligungen AG

Am Silbermannpark 1b

86161 Augsburg

fon: +49 (0)821 450420 0

fax: +49 (0)821 450420 19

Here you find us:

Feel free to contact us!

+49 (0)821 450420 0

©2024 Franz AG

Design & WordPress

www.creationell.deDesign & WordPress